House prices are affected by three key factors:

1) Supply and demand. If there aren’t enough homes on the market to satisfy the number of people who want to buy, competition for available properties will drive prices upwards. However, over the past 12 months, on average, there hasn’t been a significant difference in the number of buyers versus available properties, although demand and supply is extremely localised.

2) Strength of the economy and cost of borrowing. When the economy is strong and inflation is low, people are generally better off and the property market moves well, with lots of activity from both buyers and sellers, which tends to result in prices moving steadily upwards.

However, high inflation over the past couple of years has pushed up bank base rates which in turn have made mortgages more expensive and devalued both earnings and savings, so there hasn’t been a huge amount of activity on either side, particularly from those who don’t absolutely need to move, and prices have been relatively flat.

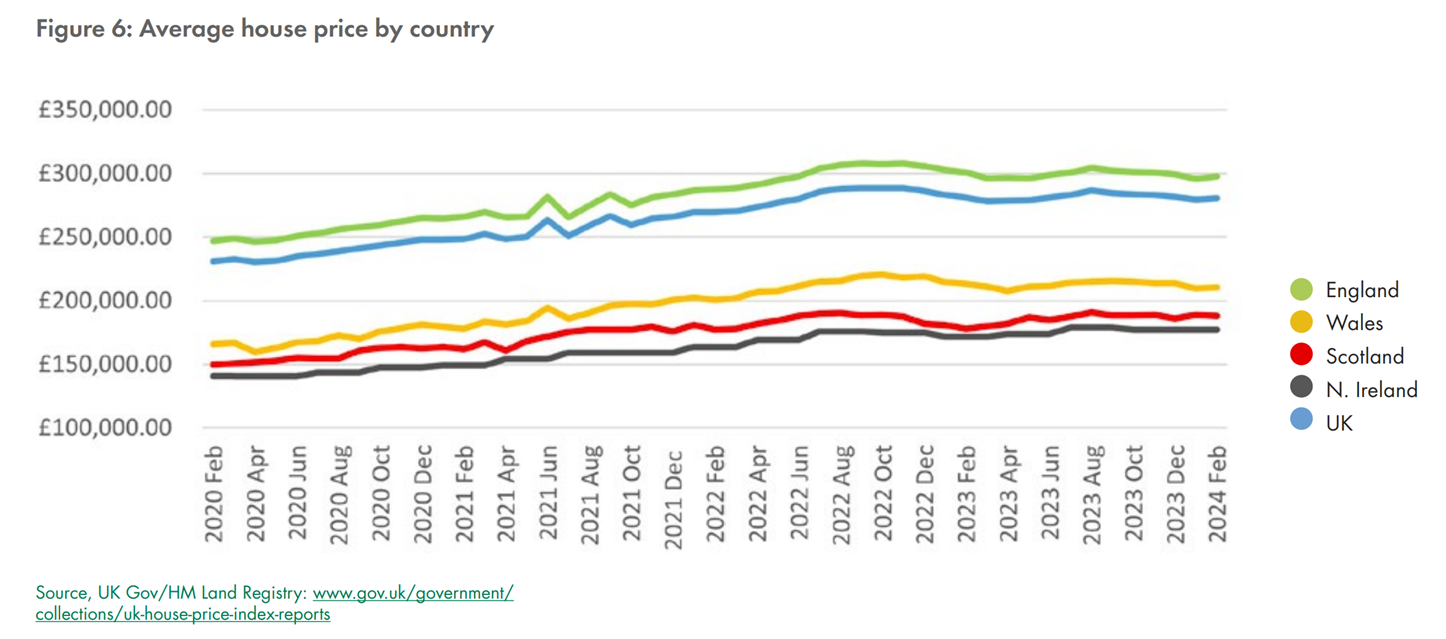

Graph obtained from Propertymark Housing Insight Report, Mar 2024

This year, inflation has been falling steadily and is currently around 4%. Although the Bank of England hasn’t yet dropped the base rate from its 15-year high of 5.2%, forecasts are that this is likely to come down over the summer and Capital Economics expects it to fall to 3% in 2025.

As the base rate reduces, mortgage lenders follow suit and we’re already seeing much better rates on offer this year, with lenders encouraged by GDP and inflation continuing to move in the right direction.

3) Consumer confidence and wage growth. Better interest rates for borrowing, Government investment in the economy and tax incentives, combined with good wage growth, all give people the confidence to move and invest in property.

For the period December 2023 to February 2024, annual growth in regular earnings was 6% and for total earnings (including bonuses) it was 5.6%. In real terms, taking inflation into account, the annual growth was 1.9% and 1.6% respectively (ONS). That means consumers are seeing a tangible increase in their income, especially those working in the manufacturing or finance and business services sectors, which saw wage growth of 6.9% / 6.8%.

So, what’s happening in the sales market at the moment?

Supply of properties falling as demand is rising

According to Propertymark’s Housing Insight Report for March, the number of market appraisals undertaken and new properties coming onto the market both fell, while the number of potential buyers registered and viewings per property both increased.

In terms of sales agreed, the average number per Propertymark member branch was unchanged from February and roughly in line with March 2023, at 7.5 to 8 per month. Meanwhile, most agents are reporting that the majority of sales are being agreed at below the asking price.

However, given that demand is currently exceeding supply ‘on average’, competition is likely to be driving prices up slightly and this should be reflected in the figures for April/May. And, as more buyers are encouraged by falling mortgage interest rates and steady wage growth, we expect more activity in the market through the summer and beyond.

Current average house prices

Zoopla’s latest House Price Index (as at April 29th), shows that the average UK property value is roughly the same as this time last year, showing a slight change of -0.2%. However, behind this average figure, some property types have performed better than others.

While detached houses have seen a 1% fall, terraced houses have increased in price by 0.6%. And, of course, price changes will vary depending exactly where in the UK your property is located. For instance, while properties in Glasgow have gone up by an average of 2.5% in the last 12 months, those in Portsmouth are down by 1.5%.

And it’s the more expensive areas that have been most affected by falling prices. Across southern and eastern areas of England, almost all markets are seeing values dropping, while no local authority areas in the North East – the UK’s most affordable region – have reported falls.

To find out exactly what’s happening in your local market, or if you’d like a current market appraisal for your home, just get in touch with your local branch and have a chat to one of the team.