Moving home is a big investment. Not only do most people tend to have a large portion of their capital tied up in their property, but the costs involved in the process can extend to many thousands of pounds. If you are both buying and selling a three or four-bedroom home, you could easily spend upwards of £15,000 on taxes, professional fees and other services.

So, it’s important to understand all the associated costs well before you begin marketing or house hunting, so that you can budget accordingly and don’t get any nasty surprises.

The three biggest costs are likely to be:

- Estate agent’s fees (sellers). Agents will charge somewhere between 1% and 3% of the sale price, depending on the quality and location of the agent and the level of service you’re getting. For example, will they do all the viewings, what’s the quality of photos they will take? Do they produce a floorplan within the fee? Or do they charge extra for these services?

- Purchase tax (for buyers). The threshold for paying and the percentage rate depends on the value of the home you’re purchasing.

- Legal costs. These are split into two parts:

#1 Conveyancing fee. This is the cost for a solicitor or licensed conveyancer to carry out the necessary work on the transaction. It can be an hourly rate but is commonly a fixed fee, based on the value and type of property, the cost is slightly higher for purchases. This fee incurs VAT which is currently at 20%.

Note that if you are buying or selling a leasehold property, shared ownership or have a Help to Buy or Lifetime ISA your conveyancing fees will be higher because of the additional legal work required.

Some legal companies will offer a ‘no sale, no fee’ option, but you are still likely to have to pay any other costs incurred over and above the legal fee.

#2 These are costs for other elements involved in completing the legal transaction, which include:

Buying: ID & bankruptcy check, searches Land Registry registration fees, mortgage handling fee, purchase funds transfer, Stamp Duty return

Selling: ID check, Land Registry documentation, mortgage redemption, sales funds transfer.

If you’re buying, there are also likely to be survey and financing fees, and you may need to pay for removals.

Lastly, if it emerges there are any issues with the property, you might have costs for things like a damp survey or indemnity insurance (this covers buyers against existing or potential issue that may be holding up a sale/purchase, such as missing building regulation certificates or a lack of planning approval).

In terms of the price you should expect to pay, the reality is that moving costs can vary significantly, depending on:

- Where in the UK you are buying or selling – for instance, costs in London and the South-East are generally much higher than in the north of England

- The type of property – e.g. size, age, freehold or leasehold, listed status

- The level of service required – e.g. whether you only need a Level 1 survey or require a Level 3 detailed building survey

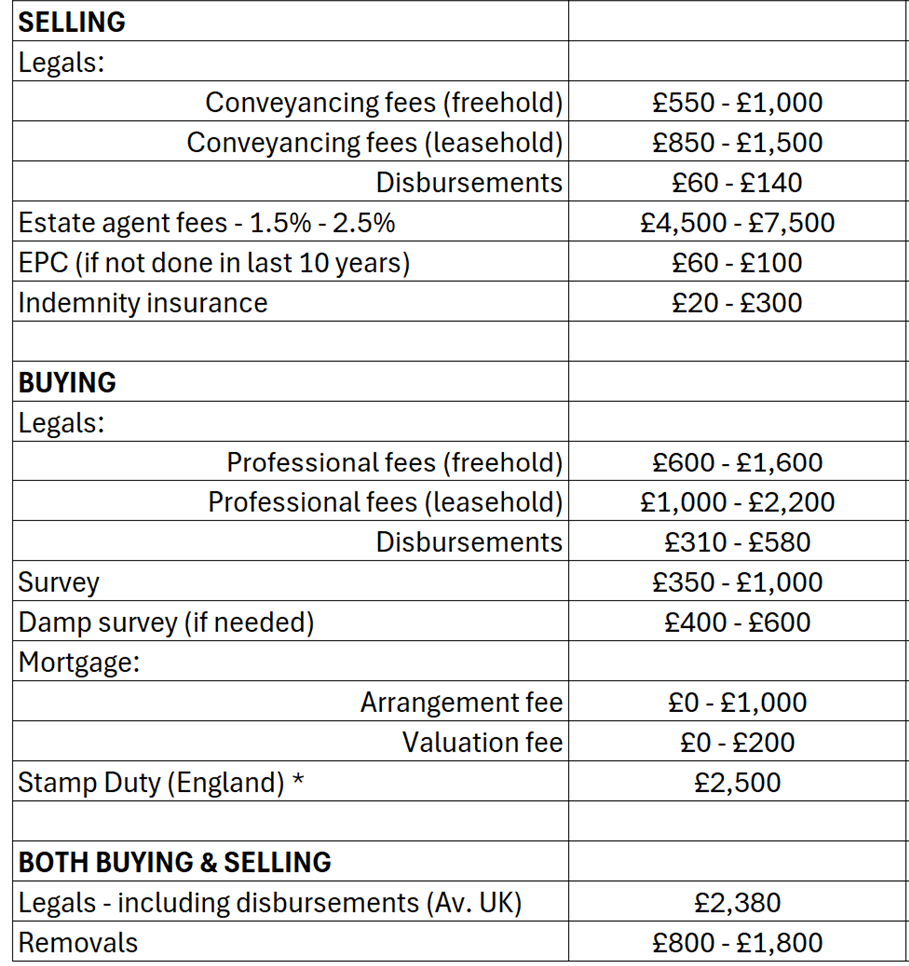

Here, we’ve put together some figures based on UK average prices for buying and selling at £300,000. If you are both selling and buying at the same time, some of your costs will be combined, such as your legals and removals.

*FTBs don’t pay stamp duty up to £425,000 in England. This is up to £225,000 in Wales with Land Transaction Tax.

Table sources: Source for UK average costs / Indemnity insurance / Damp survey / Removals

To get a much more accurate budget for your own home move, get in touch with the sales team in your local branch. We are always here to help and can recommend local professional service providers that can assist you every step of the way.